Earlier this month, I saw a tweet from Freya Mars wherein Mars was calling out Sext Panther, saying she had not been paid for work she’d completed via the platform — “When the people making money off your labor don’t actually view your labor as real work.”

In a really brief sum up, Mars alleged that Sext Panther did not pay out the full amount of monies owed to her. Sext Panther Support countered, stating that the transactions responsible for Mars’ earnings had involved fraudulent credit card use, among other issues. As such, even the partial amount they did pay was at their loss.

You can read the entire breakdown of what happened, including clarifying correspondence with Mars and clarifying correspondence with Sext Panther Support, right here.

The Hidden Third Party: Billers and Payment Processors

The Mars/Sext Panther situation brought up a key question: Who the heck let the fraud go through?

In disputes between platforms (e.g. Sext Panther) and their users (e.g. Mars) regarding customer fraud, one party is often left out — the biller, or the payment processor.

Because of endless laws and regulations (as well as sex work stigma, but I’ll get to that), platforms like Sext Panther don’t ordinarily have a merchant account with a bank and, thus, are unable to process payments themselves. Instead, they go through a third party biller. This entity — the biller — maintains a direct relationship with all sorts of banks, enabling them to process payments more seamlessly for services like Sext Panther.

So, what is a biller’s role in and responsibility to platforms and their users — or, “merchants” as they’re called in biller-speak — in the case of customer fraud?

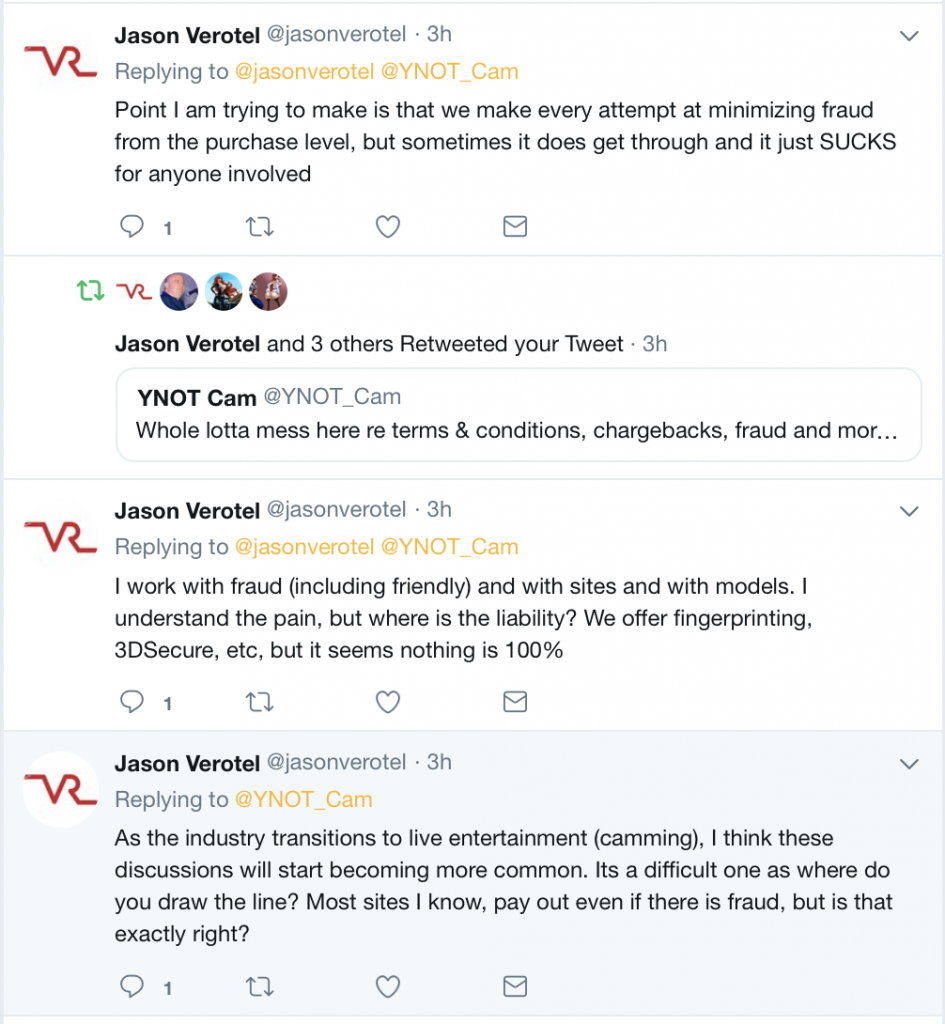

I reached out to Sext Panther’s biller back when this whole issue was unfolding, but they never responded to me. Serendipitously however, a person named Jason Collins — who works with an organization that is not at all involved with this Mars/Sext Panther thing called Verotel — made a couple comments on Twitter about the situation. I reached out to him, and he kindly answered some general questions about these issues.

Collins is Verotel’s Business Development Manager and is responsible for sales. He has been working with Verotel for almost six years. Prior to moving to Amsterdam and joining Verotel, he managed small-t0-medium business accounts for JP Morgan Chase.

Umm, Collins is clearly no slouch. Here’s what I asked him, followed by what he had to say.

YNOT Cam: In layperson’s terms, what does Verotel do?

Jason Collins: In the simplest way possible, our merchants — sites, models and talent — leverage our relationships with various banks and use our services as a sort of middleman to avoid having to establish these partnerships themselves.

In addition to “just” processing, we also provide user support. Think customer service. If a user forgets their login credentials, we have a team standing by to help them out or we can confirm what they purchased and to what site if they have any questions about the transaction on their statement. If there are issues with a site, we notify the merchant so that they can check to see what happened if they don’t know already.

These are some of our additional services that we provide in addition to the very “basic” credit card processing. This is one of the reasons why are services are higher than say a mainstream biller.

Why do we need “industry billers”? Why can’t we just use PayPal, etc?

PayPal is not publicly working with the adult industry and this also includes some banks. There are plenty of adult sites and talent who have started off with PayPal. Once you start hitting some volume, you will trigger alarms and PayPal can freeze your account and keep your balance. Use caution when working with PayPal. Even one-offs on your account can get your account flagged if they think it’s for adult.

We have a twenty-two-year history working with banks, and this is part of the value that we provide. Verotel understands the adult industry and PayPal does not. Your card processing will work, and your funds will never be frozen. Also think PCI compliance: This is the safe storage of user information including credit card data that is required with the card schemes in order to do business.

[Editor’s note: Under no circumstances should you use PayPal for any payment processing in the industry or for industry-adjacent activities. They are very anti-sex media and horror stories abound.]

What services does Verotel offer to protect from fraud? Why, as you wrote on Twitter, does it seem that nothing is 100 percent?

For fraud prevention, we use our own proprietary technology that we have been developing over the past twenty-two years, along with a third party that creates device IDs – or, a fingerprint — for all of the devices we process for and for the thousands of other online retailers that they work with.

In addition, we offer additional tools for our merchants to take further action. Say for example, they see patterns on their own. They can add to their own blacklist and create a custom blacklist. These blacklists prevent users that match certain criteria from purchasing in the first place.

Two of the most common types of chargebacks are Lost and Stolen. These are transactions done with a lost/stolen credit card. There’s also “friendly fraud.” These are valid transactions where a customer later calls their bank and has them reversed.

It’s important to know that, whether you establish a relationship with a bank or work with a processor, someone is grading your chargeback ratio. This is the number of chargebacks divided by the number of valid transactions. The score cannot be higher than one percent with both Visa and MasterCard — and there is even talks of lowering this number further.

Online transactions are very easy to reverse and only take, in some cases, a quick call to the customer’s bank. There is technically no card swipe, pin or signature done at the point-of-sale, and this is what makes these transactions easy to reverse. It’s important to know that banks charge a chargeback fee. We do not pass this down to the merchant or the site, but you will pay this if you work directly with a bank. Fees are how a bank makes money. This is something to think about.

While you can dispute [chargebacks] from a merchant perspective, your guaranteed rate of success is very low. If the card is stolen, the bank will reverse this transaction without question. You can sell a custom video for $200 that required you to purchase makeup, costume, props, etc and later find out that the person purchased with a stolen card and there is nothing you can do. Unfortunately, this is a sad reality.

I work with fraud (including friendly) and with sites and with models. I understand the pain, but where is the liability? We offer fingerprinting, 3DSecure, etc, but it seems nothing is 100%

— Jason SkyPrivate (@JasonSkyPrivate) April 17, 2019

When you said “Its a difficult one as where do you draw the line? Most sites I know, pay out even if there is fraud, but is that exactly right?” what do you mean?

There is a lot of competition right now in this part of the industry, and some of these sites are paying out chargebacks to remain competitive. Site A could potentially say “No,” and so Model X is going to move on to site B. To try and avoid losing Model X, Site A pays them [in spite of the chargeback].

Personally, I don’t think it’s right to pay Model X because if Model X went to the bank, they would still lose this transaction. But again, some sites are doing this an effort to save the relationship — and the traffic — from Model X. Give and take, I suppose.

What’s the most important thing for models/performers to understand in terms of fraud and payouts?

Everyone is playing a very new game. Online adult entertainment is new – key word — online. It’s only been around for the past twenty-something years. This is short when compared to the entire history of the adult industry.

As a result, laws and rules are being adapted on the fly. Right now, they are a bit behind when compared to purchasing content from a brick-and-mortar store, be it an adult video store or a club where live entertainment occurs. I believe based on my previous discussion that it’s also clear that the only winner with a chargeback is the cardholder and the bank, not the site or the model and not the biller.

It seems like a savvy platform or model would want to look at a biller’s fraud protections success rate in advance of opting to use that service. Where can people go to see a biller’s “fraud allowance rate,” or whatever you might call it?

Referencing my previous statement, the online industry is still very new. At this moment, there is no public fraud score for any biller that I am aware of. Depending on the relationship you establish with a bank, fraud prevention could be required from the site/model side, and this is another reason for our high fees as it comes bundled in.

Contact Collins via jason@verotel.com.

—

I am super grateful to Collins for taking the time out to explain some of this stuff to us. Billing is a complex process, made even more messy by the wild and sustained stigma coming from the civilian world that sex-related entertainment must contend with.

As the master of your own empire — You run your own business! — who utilizes many different services, it’s worth your time to think these issues through. There’s some fucked up stuff embedded in all these relationships, but everyone in the adult industry, from models to billers, is dealing with the wider discrimination and stigma put upon sex media. This stigma impacts every aspect of business in this space.

—

Erika is a sex positive people watcher (and writer). Email her at erika@ynotcam.com.