Everyone knows how to use money, right? You earn it, you spend it and you try to live within your means. That’s great for daily life, but what about those “someday” dreams you have for your whole life – things like opening a squirrel sanctuary… or being permanently debt free?

If your current financial situation is preventing your big dreams from happening anytime soon, you can still start making a plan to get there eventually. It starts with the basics, of course, and the first part of this series is about using a budget as tool to help you reach your goals.

Budgeting Basics (and Specifics)

Budgeting is something that everyone with serious financial or personal goals needs to do. Not only do monthly budgets give you information about exactly where your money goes, it gives you the opportunity to make conscious choices and changes according to that information. One popular way of getting that information is the Zero Based Budget (ZBB) method, a budgeting philosophy created in the 1970s.

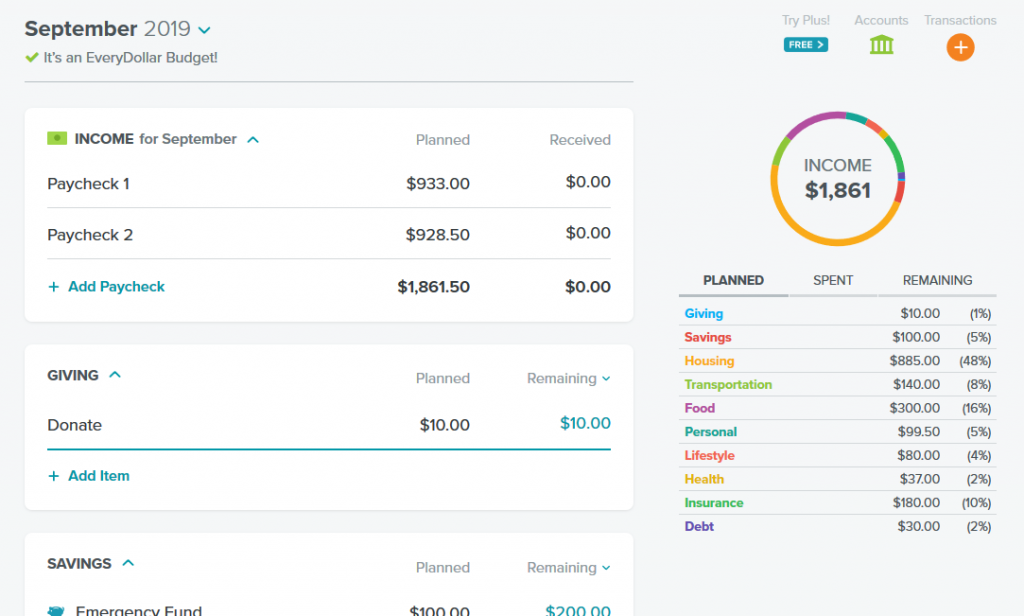

What’s unique about the ZBB is that it requires you to assign every dollar in your budget to a bill so that there is no money left. Normally, a typical budget lists income and expenses but doesn’t account for any leftover money after bills are budgeted for. The ZBB asks you to think of ways to spend every dollar so that there is no leftover “free money” in your budget. Below is an example of the ZBB. Notice there is $0 leftover to spend.

The EveryDollar app has a clean interface and options to customize your budget.

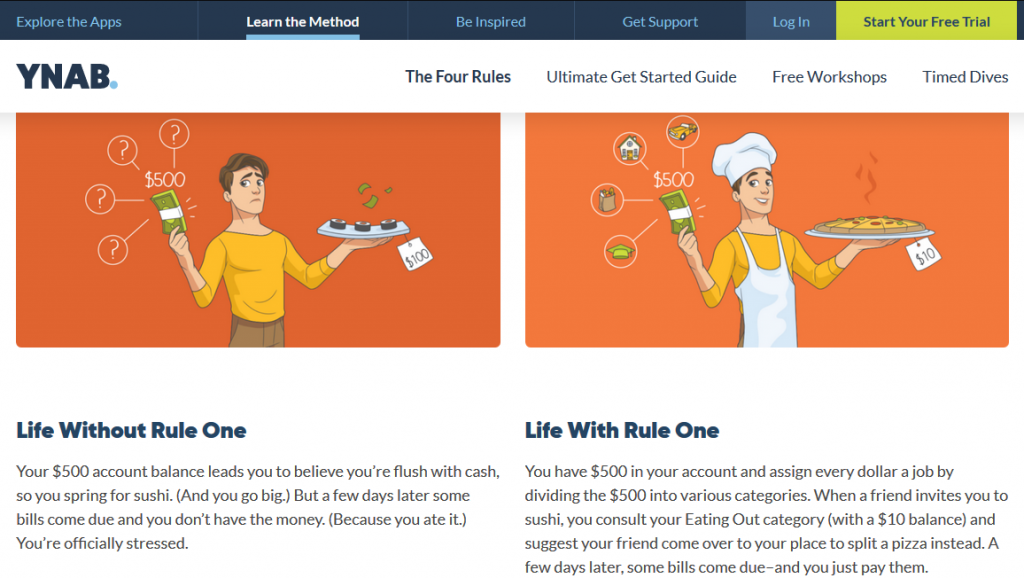

There is a lot of information that compliments the budget making process, so I encourage you to explore some of the links below for more background before you start. Two places with a wealth of information are Every Dollar and You Need A Budget, or YNAB.

EveryDollar is a free Zero Based Budget app created by Dave Ramsey, a popular financial guru and business leader. EveryDollar is useful for making an electronic budget (Just don’t link your bank account!) and for getting familiar with Ramsey’s signature advice, such as the “7 Baby Steps.” The other resource, YNAB, is a paid Zero Based Budget app with a fantastic website. Their blog and podcast are both full of free content so you can learn more about personal finance and its real life applications.

There’s just two other important things that matter before a budget can be made.

First, gross pay and net pay. When you get paid, gross pay refers to what’s earned before any taxes are taken out. Net pay, however, is how much you actually take home after taxes and other deductions are withheld. When you get a payment from a cam site, the Social Security and Medicare taxes that employers normally deduct are not withheld, so that payment is considered gross pay. This matters because when it’s time to file taxes the IRS will expect you to pay them their share of your gross payment.

Rule One from You Need A Budget helps you avoid stress.

Speaking of taxes, whether you do adult work (or any work) as an independent contractor or as a legally registered small business, your income will be subject to taxation for self-employed individuals.

Editor’s note: Nothing related to taxes is a joke. Please, please always pay attention to your taxes and seek advice from an accredited, licensed professional if you need.

Taxes are higher for the self-employed, so one piece of advice is to set aside 25 percent of your income to cover taxes and to pay them quarterly instead of yearly. This means that 25 percent of your income has to be set aside for taxes before you make your budget. Remember to keep track of your work expenses and report them as tax deductions to balance it out a little.

Make Your Own ZBB in Four Steps

Gross pay, net pay, taxes and lots of financial advice! It can get overwhelming, but the goal of a budget is to clear up financial confusion. So, without further ado, here are four steps to make a Zero Based Budget based on all of the above.

Step 1: Start your monthly budget today with the money you have now

Even if it’s not the 1st of the month, list all the money that you have now. Then list the sources of income you expect to receive during this budget period. If your income varies, estimate your lowest pay.

Step 2: List your true expenses

Your true expenses are both your regular monthly bills (rent, utilities, debt payments, savings, etc) and all the other expenses you can anticipate but don’t typically save for. We all know that we have bigger bills that come once or twice a year, or even big “emergencies” that we hope don’t happen, but it’s rare that they are budgeted for. Now you’re being asked to budget a little each month for the big expenses and the unexpected expenses that you know will be coming.

This is a good time to make a totally separate list of all those bigger, less frequent expenses you have during the year. New tires for you car, a year’s supply of contacts or a friend’s wedding are a few examples of larger, less frequent bills.

Once you’ve listed them, break them down into monthly payments you can afford so that you are prepared when the time comes. Using contacts as an example, instead of paying $200 for a supply at your next eye exam, you would save $20 a month for ten months prior. Add your true expenses that you are budgeting for to the list with your monthly bills and then go onto Step 3.

Spend some time each week comparing you receipts and online bank transactions to your budget. Are you spending too much or do you have “extra” money?

Step 3: Assign every dollar in your budget a job until there are $0 to dole out

First, calculate how much you’re going to take out and save for taxes. Then, use the remaining money to make your budget.

Take every dollar in your income and write how you’ll spend it. The four most important things your money will go towards before anything else are food, shelter, utilities and transportation. After that, your other bills need to be paid, like loan payments or a gym membership. Then budget for your personal expenses (toiletries, entertainment) and for your larger, longer-term expenses, like contacts.

Finally, if you have any money left, put it towards an emergency savings fund with the goal of saving $1,000.

Step 4: Record your transactions, save your receipts and adjust as needed

Your budget needs some meticulous record keeping to be fully functioning. It might sound inconvenient, but I recommend keeping a master transaction list in your car or bag so you can jot down everything you buy after you buy it. In addition, save your receipts during the budget period in an envelope at home to help you remember what you bought if your list gets lost or neglected. Last, adjust your budget as needed by comparing it to your actual expenses (receipts and online bank transactions).

If you have extra money or have gone over budget, use your records to write a new, more accurate budget. Remember, there is no extra money in a ZBB, so put it in your emergency fund if you have any.

#SquirrelSanctuaryGoals

Budgeting is quite basic and not at all glamorous but this thoughtful planning is going to pay off… literally. The lack of stress you’ll have when you can pay for a big expense that you budgeted ahead for will be priceless, and less stress is always a good thing for everybody. Remember this can be a trial and error process so cut yourself a lot of slack for the first few periods, and try to have some fun with it. Make your budget work for you!

Do you follow a budget or have an emergency savings fund? Hit us up on Twitter to let us know if you’ve got any money savings tips you’d like to share!

—

Anouk Gilmour is a registered yoga teacher at the 200-hour level. Eight years after trying camming in college, she is an amateur adult model again.

[…] Check out “Design Your Dream Life, Part 1: Budgeting” right here. […]

[…] out “Design Your Dream Life, Part 1: Budgeting” and “Design Your Dream Life, Part 2: Perspective Shift” for more information and […]