Wow, here we are in October. Yes, the fourth quarter of the calendar year is upon us, which means it’s time to start thinking about your year-end accounting.

One of the most important year-end actions is sending 1099s to independent Contractors (ICs). Many small- and medium-sized businesses do not send them, thinking it’s not a big deal, they don’t understand the purpose, or they just forget to do so. My suggestion is to think of sending 1099s out is just as important as issuing W2s to employees.

As an accountant, the following are common comments I or my clients hear:

“I don’t need to send any 1099s. It’s not a big deal and I don’t feel like getting the W9 filled out.”

“Why did you send me a 1099? I thought I was being paid under the table?”

“My accountant friend said I shouldn’t have to fill out a W9.”

Many businesses get very confused when it comes to sending 1099s to contractors or non employees. So do those who receive the funds. They don’t want to receive a 1099 and have to claim the income, or they don’t think they should be receiving the tax statement because they don’t understand the reason for getting one.

Many businesses get very confused when it comes to sending 1099s to contractors or non employees. So do those who receive the funds. They don’t want to receive a 1099 and have to claim the income, or they don’t think they should be receiving the tax statement because they don’t understand the reason for getting one.

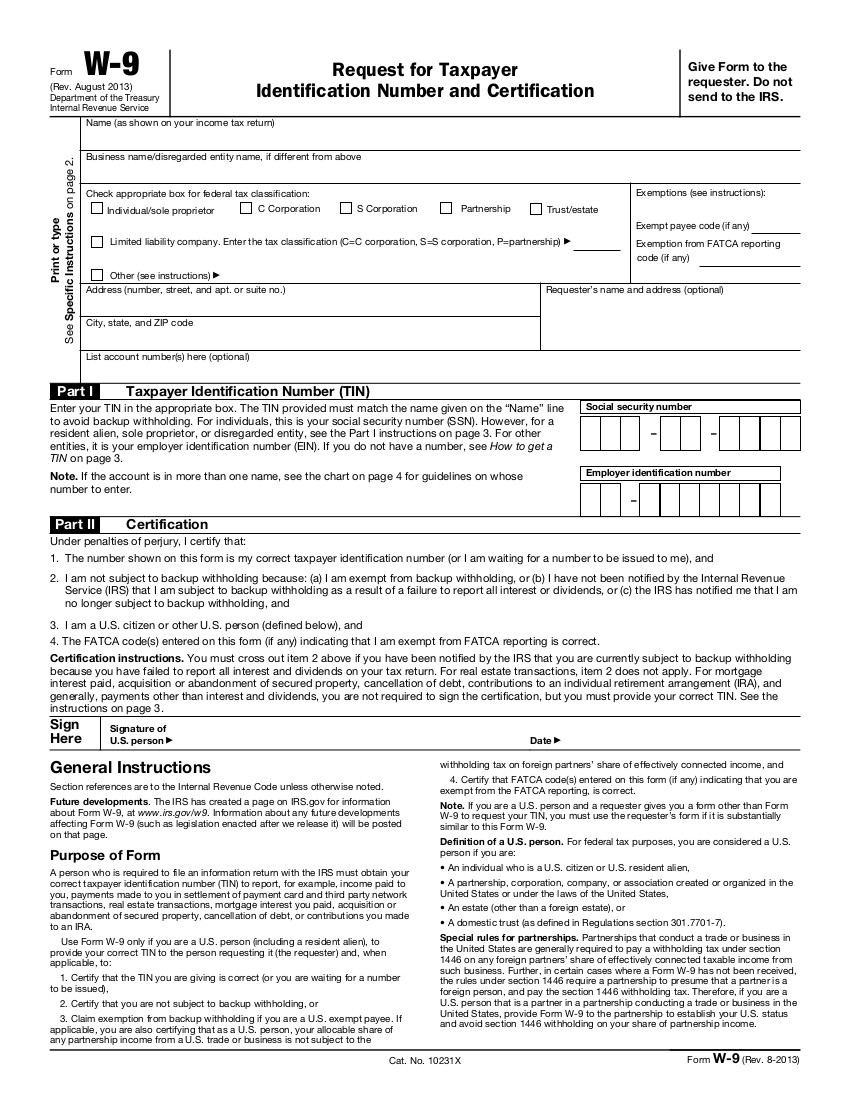

One thing I tell all clients is everyone must fill out a W9, unless of course it’s a large corporation (e.g. Staples) or someone living in a foreign country. This allows my client to be compliant in all cases. I would rather send out too many 1099s than be non-compliant.

Here are some steps to keep in mind. They should help.

1. If you pay a contractor before getting a completed W9, good luck getting one at year-end or in January. (The forms need to be mailed by the end of January.) To make sure you are in compliance, let your contractor know that you require a completed W9 before any check is issued. If the check is under $600 they may balk, since that’s the threshold for sending out 1099s, but it’s good to have one on file in the event you pay the contractor again during the year.

2. The payment of $600 is for rent, services — not goods or reimbursements for business-related expenses — completed over a given calendar year (January to December), or personal-related expenses (i.e. If you are remodeling your home, you don’t have to have contractors fill out a W9 since you are paying with personal funds).

3. A 1099 normally doesn’t need to be issued to C or S corporations, but among those who must get a 1099 are attorneys. LLCs need to get a 1099.

4. One major issue is understanding the difference between a 1099 contractor and an employee. If the person is a front-desk person, using your computer or paper, or you direct the hours the person is working, he or she is an employee. If the person is a web designer, using their own computer, working from home and setting their own hours most likely they would be considered an independent contractor.

One big problem I often see, as in my example with the front-desk person: The employer decides to pay the front-desk employee as a contractor and doesn’t withhold taxes figuring the front-desk person receives “more money” that way. This is a major problem. If the employee is let go, the business closes, etc., when the front-desk person applies for unemployment they aren’t eligible, since no taxes were paid on that employee‘s earnings because they were treated as a contractor. The next thing the employer will get is a letter from the state unemployment office requesting more information about why the business didn’t pay taxes. The state will let business know the person was not an IC but an employee, and the business will have to pay taxes and possibly penalties for noncompliance. Please keep this in mind when hiring someone or taking a job. Make sure the position is classified correctly, either as an employee or IC.

When you file taxes, your CPA or tax preparer must check a box certifying whether 1099s were filed. If you do not comply, you risk significant penalties. As one CPA I know told one of our clients, “You are risking having to pay 30 to 38 percent in federal income taxes (state regulations vary) on behalf of the vendor. If you intend to write off the expense of paying someone to do a job, the company must collect taxes from the person who received the income.

It’s really a very simple task. Require a W9 from the beginning of your relationship with a contractor. The good news is that accountants can perform this service at reasonable rates.

—

Princess Accountaholic is an Accountant who works with adult-industry clients. She’s an expert about the laws and regulations governing the industry’s taxes and where legitimate tax savings may exist. Contact her at virtualfinancexxx@gmail.com.